How do pension scams work?

Pension scammers target pension pots of all sizes, relying on deception, scammers can be articulate and financially knowledgeable, with authentic looking websites, customer testimonials and advertising that looks genuine.

Scammers will design attractive offers to lure you in; downplaying the risks to your money to try and persuade you to transfer your pension pot to them or to release funds from it.

If you suspect a scam or think you have been the victim of a scam on the policy that you hold with us, contact us online or using the contact details provided on your policy documents. It’s also important to notify your bank and report scams to Action Fraud.

- Anyone can be the victim of a pension scam, no matter how financially savvy they are. We want to help you spot the warning signs and keep your pension safe.

- In 2018, the average pension scam victim lost £82,0001

- 22 years of pension savings gone in 24 hours2a

id

|

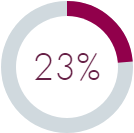

23%would engage with a cold call from a company asking to discuss their pension plans. |

|

Contact out of the blueScammers may contact you out of the blue. Any unsolicited contact from an unknown company is likely to pose a high risk or be a scam. |

|

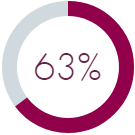

63%would trust a stranger offering pension advice out of the blue. |

|

You might be offered: A free pension reviewBe wary, professional advice on pensions is not free – an offer of a free pension review from a firm you've not dealt with before is probably a scam. |

|

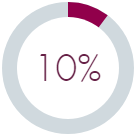

10%10% would say yes to a free pension review from a company they've never dealt with before. |

|

A promise of high or guaranteed returnsAn offer of high or guaranteed returns on your pension savings that sounds too good to be true is most likely just that! |

|

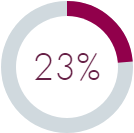

23%would pursue an offer of high risk investments |

|

Access to your pension before age 55If someone contacts you offering to help you access your pot before the age of 55, it’s very likely to be a pension scam. You could lose your money and face an additional tax charge of up to 55% of the amount taken out or transferred, plus further charges from your provider. |

|

13%would pursue an offer guaranteeing returns of 11% on their pension savings. |

What should I do if I’m contacted?

-

Don’t be rushed or pressured into a decision

Pension scammers may try to rush or pressure you into making a quick decision, they may promise a time limited offer that is exclusive to you. Scammers have been known to send documents with couriers, who wait whilst you sign.

Take your time and seek advice. If you’ve been contacted out of the blue, reject the offer and contact your pension provider. Contact details for Phoenix Life policies can be found on your policy documents, or contact us via our website.

-

7% would say yes

to a company who offered a special deal that won't be around for long and offered to send a courier to sign the paperwork immediately.

-

24% said they’d spend less

than a day choosing a pension offer2a.

You should take more time to consider such an important decision.

-

Check who you’re dealing with

Check the FCA's Financial Services Register, to make sure that anyone offering you advice of other financial services is authorised to do so. They should also be permitted to provide services in relation to pensions.

You should consider using:

- A financial adviser – If you need help in finding a regulated adviser, please visit Unbiased or alternatively you can visit our financial planning section.

- MoneyHelper is here to make your money and pension choices clearer. Here to put you in control with impartial help that’s on your side, backed by government and free to use.

- The Pension Wise service is now part of MoneyHelper. The easy way to get free help for all your pension and money choices.

- Online at Action Fraud or by calling 0300 123 2040.

- If you've already agreed to transfer your pension and now suspect a scam, contact your pension provider straight away. They may be able to stop a transfer that hasn't taken place yet.

If you're unsure please contact us or for further information please visit the following websites by clicking the links below:

- Action Fraud – Pension scams

- Citizens Advice – Advice on scams

- FCA – ScamSmart

- FCA – Protect your pension pot from risky investments and scams

- MoneyHelper – How to spot a pension scam

- The Pensions Regulator – Pension scams

1 In 2018, 180 people reported to Action Fraud that they had been the victim of a pension scam, losing on average £82,000 each. The true number of victims is likely to be higher as scams often go unreported and those affected may not realise they have been scammed for several years

2 All figures, unless otherwise stated, are from Censuswide commissioned surveys:

2a Two thousand and five adults aged 45-65 with a pension. Fieldwork was undertaken between 8-10 October 2019.

2b Two thousand and twelve adults aged 45-65 with a pension. Fieldwork was undertaken between 24-28 June 2019.The 42% figure is the percentage of the respondents who would take at least one or more actions that could expose them to a pension scam, when presented with six scam scenarios

3 Population data is indicative based on FCA Financial Lives pension holder data.